Cryptocurrencies have become a significant disruptor in the financial world, blending technology, finance, and innovation. Their unique characteristics and evolving use cases have presented unprecedented challenges for accountants and auditors. This blog explores the foundational frameworks, standards, and best practices in accounting for cryptocurrencies.

Cryptocurrency is a form of digital currency designed to serve as a medium of exchange. This means it can be used for financial transactions (provided the counterparty accepts it) and for investment purposes.

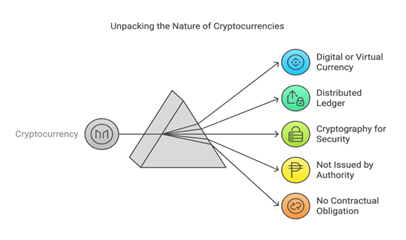

The IFRS Interpretations Committee (IFRS IC) describes cryptocurrency as a type of crypto-asset characterized by the following:

Bitcoin, for example, would meet this definition. Cryptocurrencies represent a subset of crypto-assets.

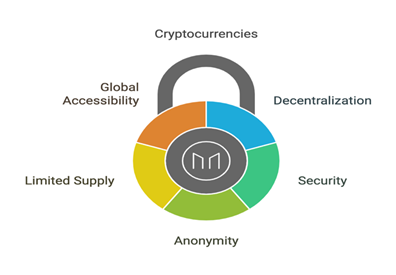

1. Digital Currency & Decentralization: Crypto currency is a form of digital currency that exists only virtually and uses cryptography to secure any transaction undertaken in it. Most cryptocurrencies operate on a decentralized network, meaning no single entity has control over the entire network. This helps minimize the risk of manipulation and fraud.

2. Block Technology: The transactions in crypto currencies are recorded in a public or distributed ledger with the use of blockchain technology which prevents it from being counterfeited or double spent. In a blockchain's distributed ledger, records are always kept in multiple nodes i.e., computers. These nodes verify and store data. Every time a new transaction is finalized, it is recorded in a 'block' of data, which is subsequently added to a chain. The entire ledger is updated whenever a new transaction occurs.

3. Economic Purpose: Cryptocurrencies may serve as a medium of exchange, a store of value, or an investment instrument.

4. Anonymity: Transactions made with cryptocurrencies can be conducted with a degree of anonymity, as users are identified by their wallet addresses rather than personal information.

5. Limited Supply: Many cryptocurrencies have a capped supply, meaning there is a maximum number of coins that can ever be created. This scarcity can drive value.

6. Global Accessibility: Cryptocurrencies can be accessed and used by anyone with an internet connection, making them a potential tool for financial inclusion.

When a transaction is initiated, it is broadcast to the network, where it is verified by miners or validators. Once verified, the transaction is added to the blockchain, and the involved parties receive confirmation.

The absence of specific accounting standards for cryptocurrencies under IFRS and US GAAP creates significant debate. Existing accounting standards provide guidelines for distinct asset classes, but there is no consensus on categorizing cryptocurrencies due to their evolving use as digital alternatives to physical cash or as investment assets. Unfortunately, experts are not unanimous in identifying crypto as a definite asset class. This is because, though originally intended to be a digital alternative of physical cash, crypto currencies are being viewed as an investment asset.

Crypto-assets come with varying terms and conditions, and the reasons for holding them differ from one holder to another. Hence, holders of a crypto-asset will need to evaluate their own facts and circumstances in order to determine which accounting classification and measurement under current IFRS should be applied.

Depending on the standard, the holder may also need to assess its business model to determine the appropriate classification and measurement.

There are two types of entities that might be interested in accounting for cryptocurrencies:

Holders of cryptocurrencies: If you purchased cryptocurrencies as a means of storing value or earning an investment return, without engaging in any "mining" activities.

Miners of cryptocurrencies: if you decided to invest in all that hardware (computers, graphic cards and other stuff), electricity and other resources with the purpose of serving the network and creating new cryptocurrency units.

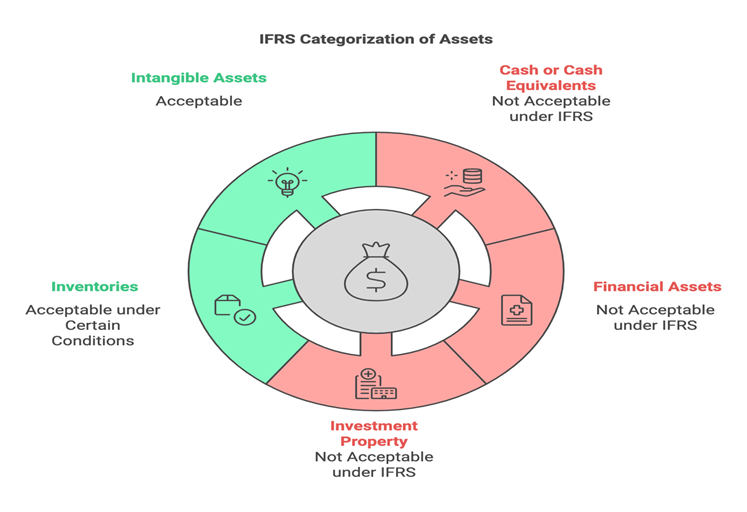

A fundamental characteristic of a crypto-asset is its nature as a digital representation, making it inherently intangible. Consequently, the following accounting standards, which apply exclusively to tangible assets, do not apply to crypto-assets:

IAS 16 Property Plant and Equipment applies to tangible items6

IAS 40 Investment Property applies to land, a building (or part thereof), or both7

IAS 41 Agriculture applies to most biological assets (i.e., living animals or plants) related to agricultural activity8

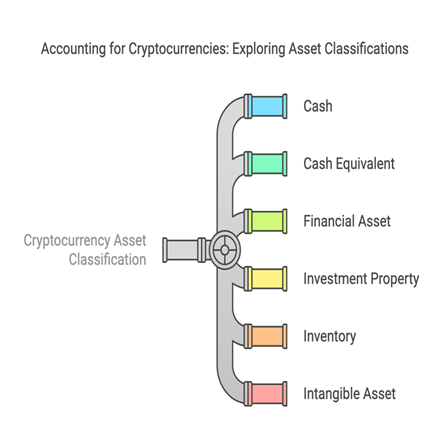

The issues relating to crypto currency accounting may be discussed from the viewpoint of holders as follows:

Accounting for Cryptocurrencies in the Books of Holders

Cryptocurrency is an asset to its holders and should be recorded as such. However, the appropriate model of its accounting depends on the class of asset

As per IFRS following are the possible asset classes to which crypto currencies may belong.

| Classification | Meet the definition? | Rationale |

| Cash | | IFRS has not provided any definition of the term cash. IAS 7, Statement of Cash Flow, only states that cash comprises cash on hand and demand deposits However, IAS 32, Financial Instruments: Presentation, states that "currency (cash) is a financial asset because it represents the medium of exchange and is therefore the basis on which all transactions are measured and recognized in financial statements." This highlights that cash, as the primary medium of exchange, plays a central role in the measurement and recognition of transactions in financial reporting. Thus, the Standard uses the term cash synonymously with currency which is recognized as legal tender (fiat currency) in each jurisdiction. Cryptocurrencies are not considered cash because, according to IFRS (2008), cash is a medium of exchange and the basis for measuring and recognizing all transactions in financial statements. The term "cash" is synonymous with "currency," which is recognized as legal tender (fiat currency) within a jurisdiction. The use of cryptocurrencies as a medium of exchange is minimal, and Although some governments are reportedly exploring the option of issuing their own crypto-assets or backing a crypto-asset created by another entity, as of now, El Salvador is the only country that has enacted legislation recognizing bitcoin as legal tender, alongside the US dollar. Consequently, cryptocurrencies do not qualify as cash. We are not aware of any crypto-asset that would currently be considered cash. If, in the future, a crypto-asset gains widespread acceptance and stability to the point where it resembles cash, the holder would need to assess whether the crypto-asset functions as a medium of exchange and a unit of account to the extent that it could serve as the basis for recognizing and measuring all transactions in its financial statements. In this case, it could potentially qualify as the functional currency of the entity. |

| Cash Equivalent:

|

| According to IAS 7, cash equivalents are defined as short-term, highly liquid investments that are readily convertible into known amounts of cash and are subject to an insignificant risk of changes in value. IAS 7 further specifies that cash equivalents are held primarily to meet short-term cash commitments rather than for investment or other purposes. Generally, an investment qualifies as a cash equivalent only if it has a short maturitytypically three months or less from the acquisition date. Importantly, cash equivalents represent a presentational category and do not determine the recognition or measurement of the asset. For a crypto-asset to be classified as a cash equivalent for presentation purposes, it must first be recognized and measured in accordance with the applicable accounting standard. The IFRS Interpretations Committee (IFRS IC) clarified in 2009 that for an instrument to be classified as a cash equivalent, the amount of cash to be received at maturity must be known at the time of the initial investment. Therefore, crypto-assets can only be classified as cash equivalents if they meet the following criteria: they are held to fulfill short-term cash commitments and have a short maturity are subject to an insignificant risk of value change, and the cash receivable on maturity is determinable at the time of acquisition.

|

| Financial Asset:

|

| Furthermore, some experts argue that cryptocurrencies might be financial assets under IAS 32 and should be accounted for as "financial assets at fair value through profit and loss (FVTPL)" per IFRS 9 due to their active market on cryptocurrency exchanges. However, under IAS 32, financial assets represent cash, equity instruments, or contractual rights to receive cash or other financial assets. Cryptocurrencies do not represent equity interest in another entity and do not establish contractual relationships between holders and other participants within the blockchain. Holders of cryptocurrencies lack enforceable claims against miners, exchanges, or other holders, relying instead on identifying a willing buyer to realize economic benefits. Thus, cryptocurrencies do not meet the definition of financial assets.

|

| Investment Property:

| | Some argue that cryptocurrencies might be classified as investment property under IAS 40. However, IAS 40 defines investment property as land or buildings held for rental income or capital appreciation, which does not align with the nature of cryptocurrencies. |

| Inventory:

| | According to IAS 2, Inventories, inventories are defined as assets that are (a) held for sale in the ordinary course of business, (b) in the process of production for such sale, or (c) in the form of materials or supplies to be consumed in the production process or in the rendering of services. If an entity holds cryptocurrencies for sale in the ordinary course of business, they may be considered inventory and measured under IAS 2. However, if cryptocurrencies are held as inventory by a commodity broker-trader with the objective of selling them in the near future and generating profits from price fluctuations, IAS 2 will not apply to their measurement. |

| Intangible Assets:

| | Cryptocurrencies may also be classified as intangible assets. An asset is defined as a resource controlled by an entity as a result of past events, from which future economic benefits are expected to flow. Cryptocurrencies, being legally owned and providing future benefits through sale or exchange, qualify as assets. According to IAS 38, intangible assets are identifiable non-monetary assets without physical substance. Cryptocurrencies meet this criterion as they can be traded on exchanges or in peer-to-peer transactions, making them separable. Moreover, under IAS 21, The Effects of Changes in Foreign Exchange Rates, a non-monetary item lacks the right to receive or the obligation to deliver a fixed or determinable number of units of currency. Given their volatile value, cryptocurrencies are non-monetary items and, as digital currencies, they lack physical substance. Therefore, cryptocurrencies can be classified as intangible assets with an indefinite useful life under IAS 38. In June 2019, the IFRS Interpretations Committee issued an agenda decision in response to a request from the IASB. It recommended accounting for cryptocurrencies as intangible assets under IAS 38, except when they are held for sale in the ordinary course of business, in which case IAS 2, Inventories, would apply. For cryptocurrencies held as inventory by commodity broker-traders, the committee stated that they should be valued at fair value less costs to sell, rather than under IAS 2. Similarly, under US GAAP, cryptocurrencies are not treated as inventory but are classified as intangible assets with indefinite useful lives. |

Based on the applicable IAS/IFRS and US GAAP, the accounting treatment for cryptocurrency transactions can be explained as follows:

If cryptocurrencies are classified as inventories under IAS 2, they should initially be recognized at cost. This cost typically includes the purchase price, irrecoverable taxes, and other directly attributable costs such as blockchain processing fees (Ernst & Young, 2021). At each reporting date, cryptocurrency inventory must be measured at the lower of cost and net realizable value and reported as a current asset. Additionally, disclosures under IAS 2 are required.

For cryptocurrencies held as inventory by a commodity broker-trader, the valuation is different. In such cases, they are measured at fair value less costs to sell, as specified in IFRS 13. Disclosures relevant to IFRS 13 must also be provided.

The IASB considers that the essential characteristics of intangible assets are that they:

Are controlled by the entity

Will give rise to future economic benefits for the entity

Lack physical substance

Are identifiable

If an item meets all these characteristics, it is classified as an intangible asset under IAS 38, regardless of the entity's purpose for holding it.

Initial Measurement:

Under IAS 38, Intangible assets are initially measured at cost. For crypto-assets, this cost typically includes the purchase price (net of any trade discounts or rebates) and related transaction costs, such as blockchain processing fees. When an intangible asset is acquired through the exchange of another non-monetary asset, its cost is measured at fair value unless the transaction lacks commercial substance or neither the asset acquired nor the asset given up has a reliably measurable fair value. In such cases, the cost of the intangible asset is measured as the carrying amount of the asset given up.

Subsequent Measurement Requirements:

IAS 38 provides two approaches for the subsequent measurement of intangible assets, allowing an accounting policy choice for each class of intangible asset:

Entities holding different types of crypto-assets must assess whether they represent distinct classes of intangible assets, as the rights and economic characteristics of crypto-assets can vary significantly.

Useful Life and Amortisation:

Crypto-assets like Bitcoin typically have no expiry date and no foreseeable limit to the period during which they can be exchanged for cash, goods, or services. Such assets are generally considered to have an indefinite useful life, meaning no amortisation is required. However, indefinite-life intangible assets must be tested for impairment annually and whenever indications of impairment arise.

Conclusion:

Cryptocurrencies have redefined the financial landscape, bringing unique challenges to accounting and reporting. Adopting best practices, aligning with evolving standards, and understanding the nuances of crypto accounting can help organizations navigate this dynamic environment with confidence.

At Virtual Accountants LLC, we specialize in providing comprehensive accounting services for cryptocurrency. Our expert team can help you navigate complex accounting standards, ensure compliance with local regulations, and manage your cryptocurrency transactions with accuracy and efficiency. Whether you're a business or an individual investor, we provide tailored solutions to meet your unique needs. Reach out to us today to simplify your cryptocurrency accounting!